Camarilla Forex Indicator MT4

Original price was: $18.00.$9.00Current price is: $9.00.

The Camarilla Forex Indicator for MT4 is a easy to use indicator that show you pivot points, entry, and exit levels. Whether you’re a new or a seasoned forex trader, this forex indicator will benifit you.

Description

Why Use the Camarilla Forex Indicator?

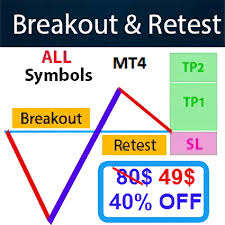

Pivot points are a go-to for many traders because they help identify potential support and resistance levels. The Camarilla Forex Indicator steps it up by automatically plotting Camarilla pivot points, standard pivot points, and mid-pivot points directly on your MT4 chart. You also have the option to enable Fibo lines, which adds another layer of technical analysis.

The beauty of this Forex indicator is its ability to identify precise entry and exit points. It helps with range-bound trading and gives breakout traders a solid edge. Plus, because it calculates pivot values based on the previous day’s data, it works perfectly on all timeframes—whether you’re into scalping, day trading, or holding longer positions.

How Does the Camarilla Forex Indicator Work?

The indicator plots lines that act as support and resistance levels. Here’s the color breakdown:

- Green Lines: Indicate resistance levels.

- Red Lines: Show support levels.

- Buy Line: Marks the point where a long position is considered.

- Short Line: Marks the entry point for a short position.

- LONG BREAKOUT Line (LB): If the price breaks above this line, it signals a bullish trend continuation.

- SHORT BREAKOUT Line (SB): If the price breaks below this line, expect the bearish trend to continue.

- LB TARGET / SB TARGET: The expected target after a breakout.

This straightforward setup makes it easy to spot trading opportunities without cluttering your chart.

How to Trade Using the Camarilla Forex Indicator

Buying with the Camarilla Forex Indicator:

- Look for Price at the Buy Line: If the Price hits the BUY line, that’s your signal to go long.

- Stop-Loss Placement: Set your stop-loss below the nearest support line to protect your position.

- Target Setting: Aim for the next resistance level or the LB TARGET line if the Price breaks out.

- Breakout Confirmation: If the price moves above the LONG BREAKOUT line, it’s a sign that the bullish trend will likely continue.

Selling with the Camarilla Forex Indicator:

- Price Hits the Short Line: Consider entering a sell position if the price reaches the SHORT line.

- Stop-Loss Placement: Set your stop just above the closest resistance line.

- Take Profit: Target the next support level or the SB TARGET line if the trend continues downward.

- Bearish Continuation: A move below the SHORT BREAKOUT line suggests the downtrend is strong and might hit the SB TARGET.

Reviews

There are no reviews yet.